Westconsin Credit Union: Buying a New (Or New-To-You) Vehicle Is Easy If You Keep These Things in Mind

V1 Staff, photos by Andrea Paulseth

“The thing that I love about my job is I have the opportunity to help members with their dreams,” Hofacker, a financial services specialist at WESTconsin Credit Union, said. Hofacker helps people all over the Chippewa Valley community access loans and build credit every day.

“Some have dreams of a new camper or auto loan or even just rebuilding credit and getting back on track. Everyone has something they are working towards. I’m glad I get to see the excitement on their faces and in their reaction when I get to give them the good news of a loan approval.”

Hofacker often works to get locals on the road by helping them secure auto loans; he offered up some professional perspective and advice on the car-buying process.

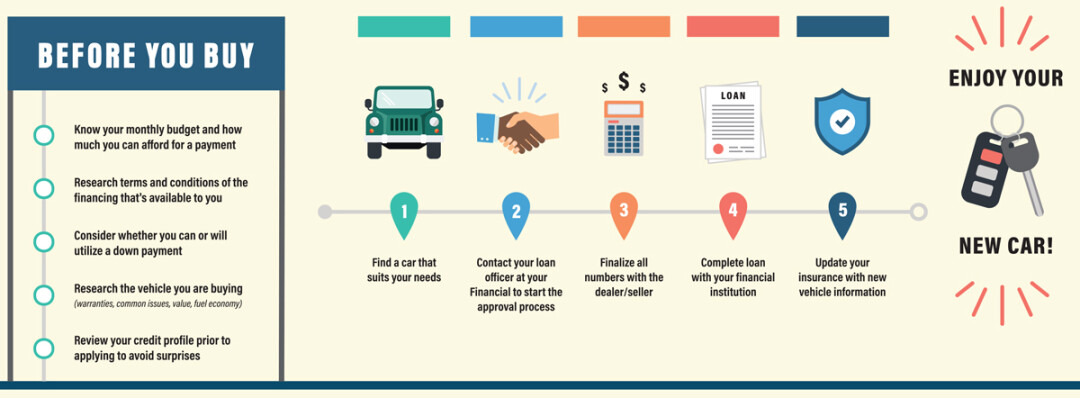

Q: What factors should someone consider to ensure an auto loan will be a good investment, in choosing a vehicle and in maintaining it?

A: When purchasing a vehicle one should consider age and miles along with, if it has any manufacture warranty remaining. This is important because repairs on vehicles are quite spendy. Knowing that it has a warranty is a good way to protect your new investment. The older and more miles of the vehicle the more likely something could go wrong, leaving you with a hefty repair bill.

Do your research on the makes and models that you’re interested in buying to see what some of the more common issues are with that particular vehicle. You may also want to consider the type of gas mileage the vehicle is rated to get as worse gas mileage means more fuel costs. You want to factor in how much this vehicle will cost you in fuel with the type of mileage you anticipate to put on it.

Q: What are some of the most common barriers to loan approval, and how does one overcome them?

One common barrier that I see when working with members is loan to value – meaning that the value of the car is less than the amount people are looking to finance once tax, title, licenses, and other fees are assessed. Some may refer to this as negative equity. Ways to overcome this include offering a down payment, having a trade in with equity, or contacting a loan specialist to take a look at values of certain vehicles to determine if you should proceed with that particular vehicle. Research online using consumer tools such as Kelly Blue Book or NADA to find values. Don’t be afraid to negotiate on price with dealers and private party purchases.

WESTconsin does offer financing for private party loans as well as dealer purchases whether it’s a car/truck, ATV, camper or boat.

Q: How can someone properly budget/plan to repay an auto loan?

A: The best way to budget/plan for an auto loan is to sit down and figure out a budget that you feel you can afford. I recommend, especially for first time car buyers, to take that amount for the next 3-6 months and put it into a savings account – and Don’t Touch It. That shows you can make that payment by creating a history for your lender to see. Also, you’ve now saved up for a down payment that you can put towards your new car.

Q: What sets WESTconsin lending services apart?

A: We try to help everyone that we can in any financial situation. Some financials have a minimum dollar requirement for a loan or only do auto loans and no personal loans. With WESTconsin I’ve seen us do personal loans for $200 to help get someone get by until their next paycheck. We have a lot of members with unique financial situations and we want them to know we are here to help them with whatever life throws at them.

WESTconsin Credit Union

Locations throughout Chippewa Valley

(800) 924-0022

JHofacker@WESTCONSINCU.ORG

westconsincu.org

This post was produced through a partnership

with Westconsin Credit Union ... Learn more!