Housing Study Examines Why Buyers, Renters Are Feeling Pinched

mismatch between supply, demand among many factors behind rising costs in E.C. County

Tom Giffey, photos by Andrea Paulseth |

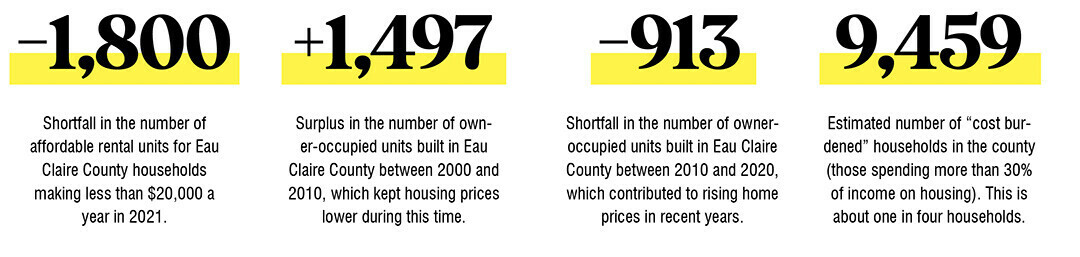

If paying for housing in Eau Claire County seems to be more of a struggle than it used to be, it’s not your imagination: Whether they own or rent, nearly one out of every four households in the county are classified as “cost burdened” – meaning they spend more than 30% of their income on putting a roof over their heads.

That’s one of numerous conclusions gleaned from the Eau Claire Regional Housing Study, which was prepared for local officials to identify housing market trends. The report was written by CZB, a planning and community development firm based in Maine, on behalf of the city and county of Eau Claire and the City of Altoona. The 92-page document, released in early December, identifies numerous factors that have caused local housing prices to rise in recent years. While ongoing national trends – such as rising interest rates and construction costs – have played a role, the report identified other factors that go back decades.

For example, as the number of jobs and residents grew during the first decade of the millennium, developers across Eau Claire County built more homes – in fact, nearly 1,500 more owner-occupied units than there was demand for, while also building fewer rental units than were needed. As a result, home prices – especially for would-be buyers – were relatively low.

“The end result is that a market historically accustomed to homeownership on a single blue-collar wage is having to adjust to a new normal which may persist into the 2030s,” the report states.

This trend reversed after the 2007-08 housing crash: Between 2010 and 2020, construction of new homes fell behind demand by more than 900 units across the county. However, the county’s population continued to grow, and the resulting housing deficit drove up prices: In recent years, the annual income needed to buy a newly built home nearly doubled, from $67,367 in 2013 to $116,775 in 2022.

The current local housing market is a result of what the report dubs “an anomalous combination” of growing homebuyer demand, particularly from millennials; rising interest rates, which have frozen many owners into their current homes, thus reducing housing inventory; and the fallout from the low level of new home construction in the 2010s.

“The end result is that a market historically accustomed to homeownership on a single blue-collar wage is having to adjust to a new normal which may persist into the 2030s,” the report states.

Meanwhile, during the second decade of the millennium, a surplus of rental units was built – more than 1,000 new units in the City of Eau Claire alone, which is twice the number of new renter-occupied households in the city. And while these projects provided choice for higher-income renters, they didn’t help those lower on the income scale: The report notes that break-even rents for new units are more than $1,000 per month, which puts them out of reach of renters with annual incomes below $35,000.

The report was recently presented to the Eau Claire City Council and the Plan Commission, and is expected to help future decisions about housing and zoning policy.

“Nothing was really earth-shatteringly new,” acknowledges Aaron White, the city’s community development director. “A lot of it was information that we expected and anticipated.”

Nonetheless, White said, the study serves as a “call to action.” When it comes to housing policy, he said, “We can’t just sit back and let things happen.”

Part two of this article, examining recommendations for the local housing market, will be published in the Jan. 11 issue of Volume One.